The business bankruptcy version of “who’s on first” is the inquiry: who is liable for this debt?

Get a clear answer or get ready for trouble.

A small business owner and his business are often indivisible in his mind.

When a bankruptcy lawyer doesn’t work to pull them apart, analytically, he should be charged with an error.

Seen at the courthouse

The debtor had been told: don’t pay this loan after filing, your liability will be discharged.

The prior bankruptcy lawyer didn’t dig deep enough to find out that the debt in question was contractually also a debt of the business entity.

The debtor dutifully didn’t pay it after the individual’s Chapter 7, and now the creditor secured by the assets of the corporation is foreclosing on the collateral essential to run the business.

Black letter law

The debtor’s discharge only protects the debtor personally from post discharge collection action: no one else. The obligations, and the exposure, of any separate business entity the debtor owns and operates, remain.

In practice

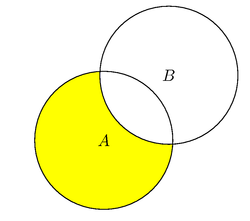

The action item from that black letter law is that you create three piles of bills when dealing with an individual and a separate business entity that expects to operate after the debtor’s filing:

- Debts for which only the individual is liable.

- Debts for which only the entity is liable.

- Debts for which both are liable.

It’s that third category that presents the problem, the intersection of the circles of liability below.

When the entity has contractual liability, failure to pay may result in unpleasant consequences to the entity.

- SBA loans

- payroll taxes

- premises leases

- equipment leases

- business lines of credit

Each of those kinds of debt are likely to be guaranteed by both the owner and his entity.

Do a UCC check under the business name. Are there creditors asserting a security interest in the assets of the entity?

When you know what the obligations of the entity are, you can advise the debtor on what needs to be paid post filing to keep the entity in good standing.

Another time, we’ll talk about remedies for the debt of the entity.

I would suggest that you look very closely at those business debts whether the debtor believes there is personal liability or not. They may have signed a personal guarantee. Worse yet, there may be a dragnet clause in the terms of the loan that could tie in with the debtor’s residence or some other collateral. Business debts aren’t for the weak BK attorney.

The flip side of the situation you describe is the individual who is “certain” only the entity is liable on the “business” credit card. I don’t think I’ve ever seen a credit card where a real, live, human being was not liable. The corporation may or may not be, but you can be sure the owner/shareholder is liable.

We just re-opened one for a client who filed a personal bankruptcy and the attorney didnt list over $500,000 of debt for the debtor’s former business. They never thought to explore whether or not the debt was guarenteed – and banks often wont respond when you do make requests.

I miss the old days from when I started to practice – list everything and let the creditors sort it out. Trustee’s trying to create “perfectly accurate petitions and schedules” miss the point of notice pleading.

I still think we and our clients should be as accurate as possible. The clients are stating under oath that everything in their BK papers is true and correct to the best of their knowledge. Further, a falsity in those papers can be used against them in a subsequent case (you swore under oath that you owed this money, etc.). I agree that sometimes this gets taken too far where it can take an unreasonable amount of time and effort to get information for a minor detail, but the other extreme doesn’t work for me, either.