The judgment was for $500,000.

The judgment was for $500,000.

Debtor’s bankruptcy lawyer was stumped.

How to schedule it?

What’s the problem? you ask.

The half million dollar judgment was in the debtor’s favor (did you see that coming?), and the debtor considered it uncollectable.

I practice before the same Chapter 13 trustee. I know his intolerance for schedules that give assets or debts a value of “unliquidated” or “unknown”.

Gotta have a number there, even if we all know it’s fictitious.

Here, consider the liquidation test if you give this paper asset a value of $500,000. You will have a 100% plan, and an absolute disconnect from reality.

How to schedule

My thought was that you have eight and one half inches, the entire width of the paper in the schedules, to deal with this asset. Use it.

Put the details from the face of the judgment in the Description column, including the amount of the judgment as entered. Put your assessment of its real world value in the far right column: zero.

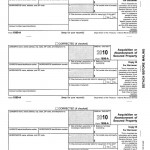

Schedule B might look like this:

Judgment for $500,000 plus interest against Judgment Debtor.

Liens perfected on already overencumbered property. Believed uncollectable value: 0

By putting the face value in the description, you’ve made the necessary disclosures. By giving it a value of zero, you’ve protected the integrity of the liquidation analysis.

No one who reads the schedules will assume that the debtor will have $500,000 to repay creditors.

I use the same approach to scheduling retirement assets that are not property of the estate. Put the details in the description along with NOT PROPERTY OF THE ESTATE in caps. Put “0” in the value column.

Plan treatment

What does the plan provide when you have an asset with utterly unpredictable value?

You can punt: provide that if debtor is successful in collecting the judgment during the pendancy of the case, he will promptly notify the trustee and modify the plan.

Or, you could say that debtor will pay into the plan all of any recovery net of collection costs and any taxes triggered thereby.

Rule of thumb

There is nothing magic about how you list things on the schedules so long as you make disclosures. Put enough information in the schedules that your reader, the trustee, understands what the situation is. Or at least is prompted to ask for more information.

Put values that are consistent with reality, so that the arithmetic calculations that your software does are not skewed by a face value that is divorced from the real world.

Image courtesy of Luca Zappa