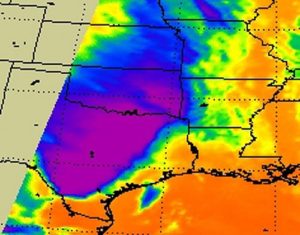

Severe weather alert: IRS turbulence spotted

Severe weather alert: IRS turbulence spotted

The head of our local IRS insolvency section announced a reading of BAPCPA which turns the law as we know it on its head.

Worse it portends surprised counsel and unhappy Chapter 13 clients if it is accepted.

Here’s his contention: the taxes associated with any tax return filed after the petition are non dischargeable.

Therefore, at the conclusion of a Chapter 13 that pays a priority tax, the debtor remains liable for interest accrued during the case and any penalties incurred for any year where the return was not filed before the commencement of the case.

This interpretation builds on a reading of §1308 which requires the debtor to file all returns for the past four tax years no later than the day before the first meeting of creditors.

I don’t understand how the Service makes the leap from the filing of the return post petition to non dischargeability, but there it is.

It renders any debtor who files a case in the early part of the year vulnerable, even though they comply with §1308 and file the return before the 341.

On that basis, the local IRS office is sending notices of taxes due to Chapter 13 debtors who have completed plans that paid priority taxes. That’s to be expected when the tax fails to meet the two year rule and isn’t a priority tax. But it isn’t expected in my office when the tax year in question is a priority year.

Is this happening elsewhere? Has anyone challenged this reading of the Code?

Image courtesy of NASA Goddard.