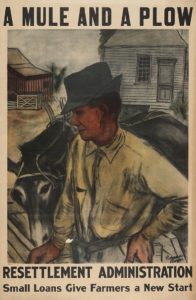

Bankruptcy lawyers occasionally are confronted with the client with more cash, or other marketable assets, worth more than the available exemptions to protect them. And state exemption systems often protect the darndest things, like a mule and a plow. A milk cow. The family bible. Those aren’t the things most of us are striving to […]

Discharging Taxes in Bankruptcy: This Year’s Trap

Income taxes are dischargeable in bankruptcy if they meet the three year rule; the two year rule; and the 240 day rule. When you count back for the three year rule (the date on which the return was last due without penalty is more than three years prior to the date the bankruptcy is filed), […]

Do Your Bankruptcy Schedules Tell the Client’s Story?

The last check before you file your client’s bankruptcy schedules should be a step back to see if the schedules “tell the story”. The background and the color don’t make it to schedules and SOFA, but you need to read them from the trustee’s point of view to see if they make sense and reflect […]