After all the time I spend cajoling, suggesting, demanding that bankruptcy lawyer READ THE CODE, I was bitten by my own advice recently.

The youngish bankruptcy lawyer had read § 109, and leapt to a conclusion 180 degrees from correct.

He was utterly right that the words of the statute talk about debts the debtor owes.

Only an individual with regular income that owes, on the date of the filing of the petition, noncontingent, liquidated, unsecured debts ….

His client had a Chapter 7 discharge and therefore, he concluded, the client didn’t “owe” anything. He reasoned from there to the assertion that there is no debt limit in a Chapter 20, despite the value of the encumbered collateral.

So here we have to access the Humpty Dumpty school of statutory interpretation:

`When _I_ use a word,’ Humpty Dumpty said in rather a scornful

tone, `it means just what I choose it to mean — neither more nor

less.’

Or more precisely, we need the Supreme Court’s take on what it means for a debtor in a Chapter 13 to owe a debt.

That was the issue in Johnson v. Home State Bank.

Farmer Johnson fell behind to the bank and filed Chapter 7, discharging his personal liability on the mortgage on the farm. Before the bank could foreclose post discharge, Johnson filed a Chapter 13 to cure the mortgage arrears.

The bank opposed his eligibility to file 13, asserting that there was no debt to reorganize, in light of his discharge.

The Supreme Court held that the rights the creditor held in rem against the farmland constituted a claim. The Justices hearkened back to a case in which they held that

‘right to payment’ [means] nothing more nor less than an enforceable obligation . . . .”

So it was sufficient for eligibility purposes that there was right to payment, even if only enforceable against the debtor’s asset.

The debt limits weren’t at issue in Johnson, so there is no discussion about § 109(e). And when I went looking for the killer case with the pithy statement that in Chapter 20, it’s the value of the collateral that defines the secured debts in the case, the pickings were thin.

Maybe after Johnson and a district court decision in Connecticut, Cavaliere v. Sapir, 208 B.R. 784, no one felt the need to challenge the idea. Cavaliere stands for the proposition that the secured claims in the Chapter 7 survive only to the extent of the value of the collateral, or on the Cavaliere facts, to the balance of the first mortgage on the home, since it couldn’t be modified. The balance of the secured claims, nearly a million dollars, ceased to exist for purposes of eligibility in the subsequent Chapter 13.

So, the moral of this story is that reading the code isn’t enough: you have to know what courts, outside the Humpty Dumpty Circuit, say the words in the statute mean.

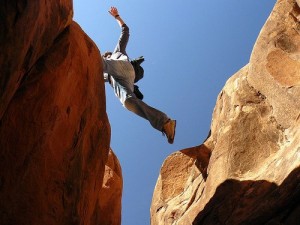

Mountaineering image courtesy of jhf; Humpty Dumpty courtesy of dacotahsgirl

So if there were a Second, with any action on the Note discharged in the prior Ch 7 and now in Ch 13 the value of that 2nd is $ – 0 – because the collateral only covers part of the First TD, is there a need to Lien Strip the valueless 2nd TD in a Chapter 13?

Yes, you need to strip the second lien.

The lien remains on the property, only the personal liability of the borrower is discharged in the 7. The lender remains free to enforce the obligation in rem.

If you don’t strip the lien, any equity in the property created in the future by appreciation or pay down of the senior debt, accrues to the benefit of the junior lien.

The property can’t be sold in the future without paying or getting the cooperation of the second.

Strip those seconds!!