Good income, substantial priority tax debt, other debt within the limits: sounds like a Chapter 13 bankruptcy, doesn’t it?

Yet the clients were in my office for a second opinion, convinced they couldn’t sustain over five years the payments their attorney provided in their Chapter 13 plan.

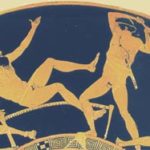

Their attorney’s approach reminded me of the Greek story of the brigand Procrustes, who waylaid travelers, offered them the “hospitality” of his home, then racked them (or lopped off limbs) to fit his bed.

Their attorney’s approach reminded me of the Greek story of the brigand Procrustes, who waylaid travelers, offered them the “hospitality” of his home, then racked them (or lopped off limbs) to fit his bed.

These people were going to fit in 13, in their attorney’s view, despite their protests it wouldn’t work.

They told me of medical expenses omitted from the budget, surgery planned for the near term, and fewer employment hours on the horizon. The payments, a stretch at this point, would be unsustainable soon in the future.

My thought: do they need a discharge of the tax debt? is there an administrative remedy within the IRS that would protect them?

Yes, said the enrolled agent I called up. With a scan of the couple’s facts, he felt confident that he could get their case tagged as currently uncollectable.

By opening up to non bankruptcy solutions, I think I got a solution that will work for the clients better than the rote selection of Chapter 13. Convert the current case to 7, discharge what’s dischargeable, then approach the IRS.

There isn’t a non bankruptcy alternative for every situation, much as our clients wish, but we need to scan the horizon for alternatives before advising the client.

Image © Marie-Lan Nguyen / Wikimedia Commons

I really like that! Are enrolled agents amenable to giving advice to attorneys? Do you hire and pay them to get advice? What circumstances might trigger a call to an enrolled agent on behalf of a bankruptcy client?

I met the enrolled agent in this story when I had clients who needed help with unfiled returns. He was practical, interested, and saw me as a resource as much as I saw him as one.

I don’t deal with the IRS outside of bankruptcy, so I needed someone to assess either the possibilities of offers in compromise or problem resolution within the IRS. We trade referrals, not money.

My name is Piter Jankovich. oOnly want to tell, that your blog is really cool

And want to ask you: is this blog your hobby?

P.S. Sorry for my bad english