Did you know that a taxpayer making a voluntary payment to the IRS can designate to which liability it is credited?

The doctrine is called earmarking and it’s really useful when a prospective debtor owes taxes for both priority and non priority years. Absent instructions from the payor, the IRS applies payment to the oldest taxes first, which may well be dischargeable.

A taxpayer who makes voluntary payments to the IRS has the right to designate to which liability the payment will be applied. In re Ribs-R-Us, Inc., 828 F.2d 199, 201 (3rd Cir. 1987); United States v. A & B Heating & Air Conditioning, Inc. (In re A & B Heating & Air Conditioning), 823 F.2d 462, 463 (11th Cir. 1987); Muntwyler, 703 F.2d at 1032; O’Dell v. United States, 326 F.2d 451, 456 (10th Cir. 1964); Avildsen v. United States (In re Avildsen Tools & Machines, Inc.), 40 Bankr. 253, 255 (N.D. Ill. 1984), aff’d on other grounds, 794 F.2d 1248 (7th Cir. 1986). When payments are involuntary, it is the policy of the IRS to apply the payments to whatever liability it chooses. Slodov, 436 U.S. at 252 n.15; Ribs-R-Us, 828 F.2d at 201; A & B Heating, 823 F.2d at 463; Muntwyler, 703 F.2d at 1032. United States v. Technical Knockout Graphics (In re Technical Knockout Graphics), 833 F.2d 797, 801 (9th Cir. Cal. 1987) overruled on other grounds.

By earmarking the payment for a priority year, the debtor making pre bankruptcy payments can pay down the non dischargeable tax including the current year’s tax liability.

I instruct clients to earmark payments where either we are trying to spend down non exempt cash in the smartest way possible, or where for some reason, we need to wait some period to file bankruptcy and the debtor is under pressure to pay by the taxing authorities.

The client should write the tax period for which he is making payment on the check and transmit the check with a letter of instruction echoing the notation on the check.

More

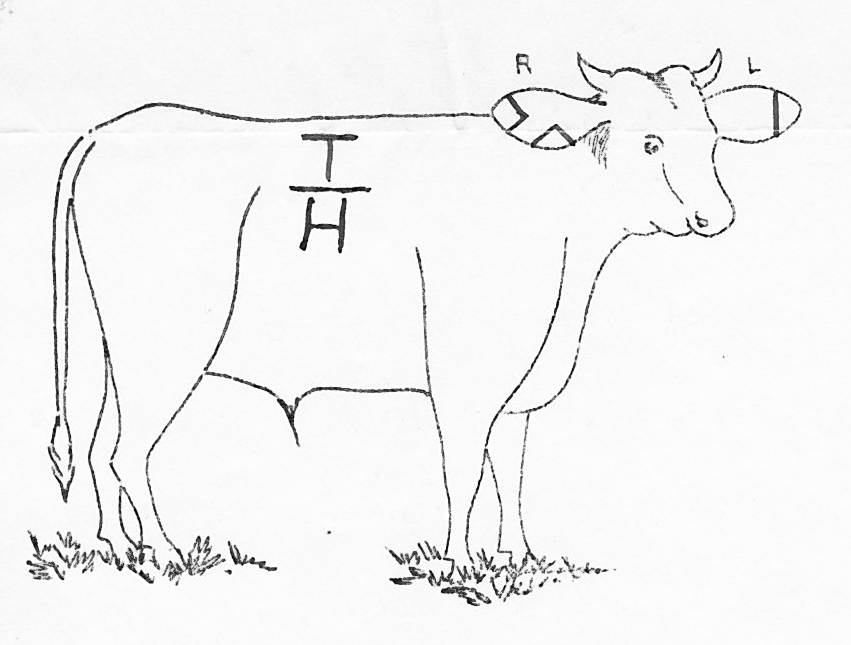

The illustration shows the brand and earmark registered in the Territory of Arizona by my great great grandmother in 1898. The notched ears added to the id provided by the rib brand.

Aren’t payments to the IRS made within 90 days still considered preferential?

Christopher J. Lane

Attorney at Law

St.Clair & Greschler, P.C.

http://www.boulderbankruptcylaw.com

http://www.stclairgreschler.com

They meet the definition except for the part that provides that the recipient must have received more than they would have had the prepetition payment not been made and the creditor paid through the bankruptcy.

If the payment is on account of priority taxes, I’ve never seen a trustee demand its return only to pay it back after taking the trustee’s cut.