Inflated value provided by client in bankruptcy schedules comes back to bite debtor when Chapter 13 plan collapses. The client’s case was driven by substantial taxes and a vehicle she just had to keep. The asset mix included a timeshare which, even at the start of the recession, she valued at far more than I […]

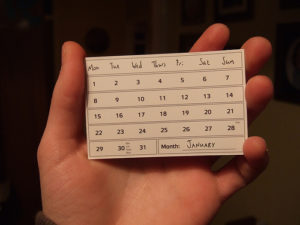

Taxes, Bankruptcy & The New Year

Consider delaying the filing of Chapter 13 cases where the debtor expects to owe taxes for 2010 til January. Otherwise the tax for 2010 is a post petition debt not easily payable through the Chapter 13 plan. It’s December and I’m trying to be thorough in asking Chapter 13 prospects whether they will owe taxes […]

Where Are The Answers For The Consumer Bankruptcy Lawyer?

Tell me what to read if my client has Issue A, and what to read if they have Issue B, the rookie bankruptcy lawyer asked. Other readers voice the same plaint: tell me where the answers are for practicing bankruptcy law. Well, I have some good news and some bad news. The bad news is […]

The Rules Change

December 1, the Federal Rules of Bankruptcy Procedure change. If you can’t tell the players without a program, you can’t practice bankruptcy law without having a handle on the federal rules. Then, of course, you need to see what the local rules add, but that’s another story. Here’s the list of rules that change. Image […]

Thanks Be

Professionally, what am I thankful for? I’m thankful for experience and a skill set useful in terrible economic times. I’m thankful for bankruptcy laws, flawed as they are, that allow people to escape debt and focus on the future. I’m thankful for an honest judiciary and panel trustee system that give the system integrity. On […]

Consumer Debt Label Matters in 13

Consumer debt? Non consumer debt? Have mostly non consumer debt and you get a pass on the means test. Where else does the consumer/non consumer characterization matter: in Section 1301, where co debtors on a consumer debt are protected by the automatic stay. Section 1301 limits the scope of the co debtor stay to consumer […]

What’s Hardest Part Of Being New To Bankruptcy?

How about we reverse the flow of information here and you tell me what the most difficult aspect of being an inexperienced bankruptcy lawyer is? What kinds of issues are hardest to get help with? What facts have eluded you in interviewing clients? What is the biggest challenge in your practice today?