Given all the energy bankruptcy lawyers spend extracting information from clients, it’s discordant to point to a situation where you, as the bankruptcy lawyer, should blow past the client’s input. But here’s the situation where that is true: Don’t list the debtor’s interest in a decedent’s estate without further inquiry. Ask the client if they […]

Get Exemption Claims Under The Limit

The rookie bankruptcy lawyer was clearly proficient at math, but forgot the bankruptcy administration end game: money for creditors. The client owned two assets with apparent equity and the available grubstake did not cover both. The attorney had calculated the equity in the home thus: (Fair market value) less (mortgage balance) less (exemption) = equity […]

How To Enforce The Discharge Injunction

Every once in a while, courts tell us explicitly how to do things. The 9th Circuit took its turn when it laid out how to get a violation of the debtor’s discharge before the court. The narrow issue in Barrientos v. Wells Fargo, 09-55810,was whether the action against a creditor with a discharged debt should […]

What The Bankruptcy Trustee Hopes You Forget

Remember the float? Your client’s check book balance may not be the funds on hand when the bankruptcy case is filed. Too often the client whips out his checkbook to tell what’s on deposit when we gather to sign the bankruptcy petition. The client has already deducted, at least mentally, the recent checks he’s written. […]

2010 Tax Return Imperative in Chapter 13

Got to file the 2010 tax return to get your Chapter 13 plan confirmed is my message to clients filing bankruptcy. But it isn’t due til April 15th and I usually get an extension, comes the reply. Not this year. A case filed at any point in 2011 includes tax liability for 2010, since the […]

Find The Avoidable Transfers Before Trustee Does

Remember “Where’s Waldo”? As a bankruptcy lawyer, can you pick the transfer out of the crowd? Transfer is a defined term in the bankruptcy code. Both lawyers and clients understand a sale or a gift as a transfer. But do you recognize the grant of a security interest as a transfer? I conferred in a […]

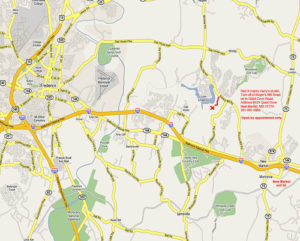

Roadmap To Car Value

When the judge’s response to a dispute about a vehicle’s value is to hold an evidentiary hearing, you’re on stage. Do you feel like the deer in headlights ? What evidence is available? Admissible? How to get it in? The newest judge in San Jose has just written an opinion that can serve as GPS […]