Cases keep getting referred to my office when the clients are over the debt limits for Chapter 13. (Debt limits are less of a barrier since the debt limit moved to $2.75 M in 2022).

The assumption seems to be that if the debt is that large, a Chapter 11 is required.

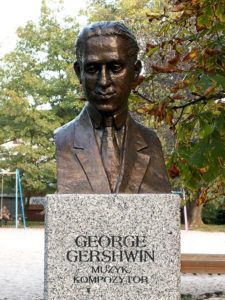

It ain’t necessarily so. (Care to hum a few bars?).

Goals come first

Client goals are the first issue when choosing chapters. If the client has something he might lose to a trustee in a Chapter 7, then a reorganization chapter may be required. An unincorporated operating business might require a Chapter 11 or incorporation, for instance.

But the cases I’m seeing seem to involve underwater real estate and sometime, over-the-top unsecured debt. Sounds like a Chapter 7 to me…

We come back to the axiom that trustees are only interested in property with net value to general unsecured creditors. It hardly matters how much the property is worth, $400,000 or $4 M, if the debt is greater than the value. Or if the debt plus capital gains taxes is greater than the value.

Step two

The next step in the analysis is to consider what the client envisions doing with his assets after bankruptcy. Before undertaking a Chapter 11 to strip off a lien, consider whether the same result might be achieved by negotiation after the discharge. Alternatively, might the same amount of money required for a Chapter 11 buy out the worthless lien?

When the the client’s theme song is I Got Plenty O Nuttin, don’t overlook Chapter 7.

Image courtesy of Staszek Szybki Jest and Wikimedia.