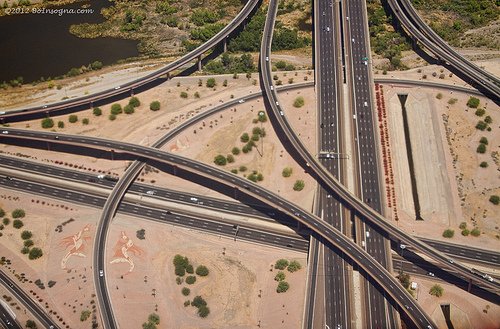

There are three labeled exits from the 910 freeway. Find one and you save your client thousands of dollars. Miss them all and you do your client a disservice.

There are three labeled exits from the 910 freeway. Find one and you save your client thousands of dollars. Miss them all and you do your client a disservice.

The infamous hanging paragraph in §1325(a) prohibits bifurcation of a creditor’s claim secured by a vehicle into a secured claim and an unsecured claim. Specifically:

section 506 shall not apply to a claim described in that paragraph if the creditor has a purchase money security interest securing the debt that is the subject of the claim, the debt was incurred within the 910-day period preceding the date of the filing of the petition, and the collateral for that debt consists of a motor vehicle (as defined in section 30102 of title 49) acquired for the personal use of the debtor…

Unless you can find an off-ramp, the debtor is stuck paying the contract balance on the loan.

Remember, however, that even a 910 car loan is subject to a Till interest adjustment.

The 910 Exceptions

- The loan isn’t purchase money This exception to the application of 506 was designed to protect car dealers, not necessarily everyone who makes a loan secured by a car. Look for loans that represent refinances of a car loan or the pledge of car to secured a personal loan. Often these refinances are done by credit unions.

- The vehicle is a business vehicle Either the nature of the vehicle or the debtor’s business should tip you to a loan that may be outside the hanging paragraph. If it’s a delivery van, Revology’s 1966 Mustang Fastback, a pickup with racks, or an SUV sufficient to haul a trailer for the debtor’s business, you may have a transaction that doesn’t involve a “motor vehicle for the personal use of the debtor.”

- The vehicle is driven by someone other than the debtor Consider whether the vehicle is driven by a non debtor. The statute speaks in terms of the debtor’s personal use, so perhaps the vehicle for the teenager or college student, or even non-debtor spouse is outside the protection of the hanging paragraph.

Keep thinking and asking questions even if the first answer is 910.

Image courtesy of Striking Images by Bo.

Cathy’s comments are right on point. It’s always a good idea to get copies of the particular loan documents to be sure how the “hanging paragraph” does – or does not – apply. You can’t rely on the debtor just to tell you the right information. And sometimes you can get past the 910 day problem by just waiting a short period to file the case.

I saw a Plan that gave 28% to a car creditor because the vehicle was purchase within a week of filing. Why, I asked? Because the bankruptcy mill lived in a creditor fantasy world where you had to give contract interest if a vehicle was purchased within 6 months of filing.

I hate it when people confuse you about things you already know. Then you spend time researching what you already know and dig through statutes and case law to determine if Congress or the Supremes somehow overruled Till when you weren’t looking.

Maybe the contract rate of interest was a locally fashioned rule that was really addressed to good faith, rather than really being about the plan rate of interest.

“Good faith” can be as powerful a tool as a judge chooses to make it, perhaps necessitating an appeal

I have a car loan and I am about to declare. My ex-spouse drives the car, and its worth about 50% of the loan value. I purchased the car well before 2 and a half years, but refinanced it last year around this time. Can I “bifurcate” it? Will I be able to place the majority in unsecured?