Regardless of the ultimate destination, all bankruptcy roads run through Chapter 5.

A few bankruptcy cases are derailed there.

Because Chapter 5 provisions tell you what comes into the bankruptcy estate, what can be exempted, and what can be changed using Chapter 5.

Sometimes the results tell you that bankruptcy is not the right choice for your client, at least at this time.

In my practice, the first meeting with the client, the diagnostic visit, if you will, is all about how Chapter 5 applies. After we pass through Chapter 5, we’ll pick another chapter as an ultimate destination.

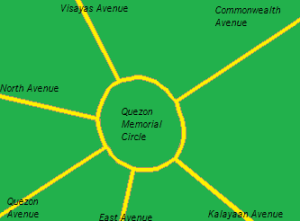

Structure of the Code

The first three chapters of the Bankruptcy Code are general provisions, nominally applicable in all bankruptcy cases.

The chapters thereafter, starting with Chapter 7, describe specific kinds of bankruptcy proceedings.

So wherever you are heading, you need to visit Chapter 5 on your way.

Property of the estate

Starting in the middle of the chapter with §541, we see what is property of the estate, subject to administration in the case.

The language of the code is broad:

…all legal or equitable interests of the debtor in property as of the commencement of the case…

In short, everything except the stuff excepted in subsection b.

That requires that I winkle out of the client not only what he owns, but how much of it he owns.

In a community property state, I need to know if the presumption of community property controls, or whether there is an agreement that rebuts the presumption.

Are there premarital agreements that alter the usual marital property scheme? Is any of the property the client’s separate property, acquired before marriage or inherited during the marriage.

Beyond tangible things, does the client own a business, have a right to sue, or stand to receive an inheritance?

Three clients in the past two weeks owned term life insurance policies on someone other than a spouse. None of those clients remembered those policies in our first meeting.

Non obvious property

A common misconception in the lay world is that a cause of action doesn’t exist until you file suit. Survey the cases on judicial estoppel and you’ll see how wrong they are.

Likewise, pending insurance claims are often overlooked. Security deposits, pre payments, store credit are worthy of inquiry. Gift cards or prepaid plastic of other kinds as well.

Paypal accounts.

Do you ask about unpublished manuscripts or music compositions? Internet domain names? Membership in class actions suits?

Equitable interests

A favorite practice of some of our clients is taking themselves off title to houses and cars to “protect it from creditors”. A bankruptcy lawyer needs to ferret out those things that look like they belong to others but are equitably property of the client.

The reverse is true, as the exceptions to §541(a) tell us. The first exception in 541(b) excludes property where the debtor can expend property only for the benefit of another. A Uniform Gift to Minors custodial account is a prime example.

Next time, we’ll cycle through another interchange in Chapter 5, the trustee’s avoiding powers.

Til then, keep your eyes peeled for property of the estate, lurking where you least expect it.

Image courtesy of kj plma and Wikimedia.